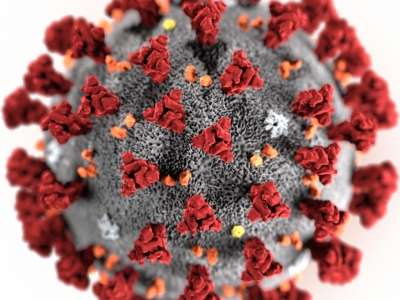

Last year was dominated by COVID-19, and it seems that 2021 will be equally plagued by the virus. However, while the pandemic caused devastating losses, both human and economic, it also produced unexpected dividends for the Marijauna Shops. Many parts of the economy were crushed, but by almost every metric 2020 was an exceptional year for the industry. In terms of both public attitudes toward cannabis as a therapeutic application and as a business and investment opportunity, much has changed.

Marijuana's in Italy has been considered one of the biggest "essential businesses" during commercial closures. Economic indices are expected to favor various cannabis sectors even and even more so in 2021. With the growth of the market in Canada, and the UN evaluative rescheduling of cannabis, there is finally a strong favorable wind. As a result, there will be a lot of investor interest, which is unlikely to stand by and watch the development of a business that has as much disruptive potential as has been seen in many years on the conscious consumption front. Last November's U.S. presidential election also helped spur optimism toward the domestic market, something that could have a positive impact on the European market as well. Indeed, the newly elected president's agenda includes North American capital invested in research and development in a big way directly in Europe. Biden's new administration will also likely prioritize opportunities related to climate change-another factor that could impact the U.S. andEU cannabis markets. There will also be ripple effects from the proposed Israeli legalization of cannabis, which will take place sometime in 2021.

As the European market grows both within the EU and in those countries outside the federation (e.g., the mature markets of Norway and Switzerland, as well as the United Kingdom), there is likely to be growth in Marijuana Shops. Not to mention the increase in imports from developing countries. For example, Australian manufacturers are getting the product into German pharmacies. There are now 68 countries with legal medical marijuana, mostly oil. Some European countries, with small initial programs, are expected to expand their market offerings, looking at more emerging markets.

In the case of CBD, the category of these "novel foods" may be changing in the minds of consumers. More generally, the gridlock around novel food applications remains, but the UK's advancement and granting of novel food supplement status to CBD could help change the EU's position. CBD has experienced a major crisis, but major challenges remain and much more work is needed to erase consumer doubts.

Marijuana in Italy and Europe compared with the U.S

The position in Europe has not been as clear as in the United States with regard to Marijuana Shops. Legal wrangling and regulatory contortions have clouded consumer judgment in Europe, and the resulting negative perceptions will require more work, and this scenario could have the effect of shutting down smaller operators, allowing the gray market to persist.

In the meantime, however, action could increase in the various CBD sub-sectors, provided consumer education matures. Negative public opinions for CBD will likely remain, as perceptions about it have been partially tainted, but it may be interesting to analyze whether those areas within CBD-such as personal wellness and pet food-will begin to generate more education.

There remains, however, a problematic lack of convergence in Europe. In the U.S., the multi-state model has worked quite well and has allowed a lot of innovation and experimentation with specific factors such as retail models, and given the market a chance to evaluate what works best. From there, a convergence of policy and business could lead to improved practices for the entire industry.

So there is cautious optimism for Marijuana Shops in the air, but the COVID-19 scenario will likely impose its constraint on economic activity for a long time to come. Right now, normalcy is unlikely by summer, and disruptions to the market, research, and development, including from a legislative and policy perspective, could extend through 2021.